As 2021 comes to an end, we’ll see Defi’s madness one more time. Terra, which focuses on defibrillation ecology, has a tied volume of $ 17.26 billion, topping the BSC and hitting a record high, second in the public chain after ETH. A number of ingeniously designed Defi2.0 projects stand out from the market and stand out in the Defi ecosystem. Assume your own position firmly; More and more investment institutions and traditional financial institutions are aware of Defi’s unwavering power and have entered the market.

As the main force behind the entire crypto market, Defi’s liquidity-based curve ecology and repeated high lock-up volume have demonstrated their transformative power to traditional finance.

Safemoon and other projects in particular have successfully proven that in the active defibrillator market, defibrillator projects with innovative mechanisms, consensus and long-term development prospects can quickly win the favor of the market.

statue of Liberty:ONE Defi project to build broad market consensus

The Defi rookie project Statue of Liberty has already done this.

Like the recently exploded Safemoon, the Statue of Liberty uses innovative mechanisms such as long-term owner incentives and automatic burnout. However, unlike Safemoon, the Statue of Liberty has a long-term development perspective and has created a broader market consensus.

Regarding the design of mechanisms, the members of the R&D team at Statue of Liberty have extensive experience in tokenomic (token economy) design. As technical lead, you were involved in designing the liquidity pool for Defi1.0 and the protocol control liquidity mechanism for Deif2.0. Thomas Smith, Safemoon’s economic architect, was responsible for the project. According to the profile, Smith has worked with various groups on blockchain and decentralized financial products as a consultant on well-known Defi projects such as Uniswap and Abracadabra for the past two years.

More importantly, Smith and Safemoon CEO John Karony (John Karony) have always worked closely together. Karony was an analyst with the US Department of Defense, and on Twitter, some analysts questioned Smith and Karony’s interest in the US government and the political layout behind the US.

In order to create a market consensus, the Statue of Liberty team established the Statue of Liberty Foundation. The SL Foundation’s senior consultant for international projects said in a recent interview that the application of blockchain technology goes beyond the realm of blockchain and achieves the practical value of demonstrating blockchain technology by focusing on social issues. In his speech he repeatedly mentioned that “unity” and “cooperation” are the key to dealing with COVID-19, that the solution should be “cooperation” instead of “isolation” and that the blockchain industry should take its social initiative Responsibility in reality.

In this way, the Statue of Liberty has created a good image for Blockchain Defi in the international community and created a solid investor consensus for the development of their project.

Safemoon’s Wealth Creation Myth

Statue of Liberty is closely related to Safemoon, from mechanics to project members.

Safemoon’s success is largely due to its high quality performance design and innovative trading mechanism, while its decline is due to the lack of long-term development prospects and continuous market consensus.

In terms of revenue structuring, Safemoon attracts users with high annual interest rates and token increases. It’s been online for less than a month and its market value has exceeded $ 100 million. In the next six months, Safemoon grew rapidly, reaching a market size of $ 11.64 billion.

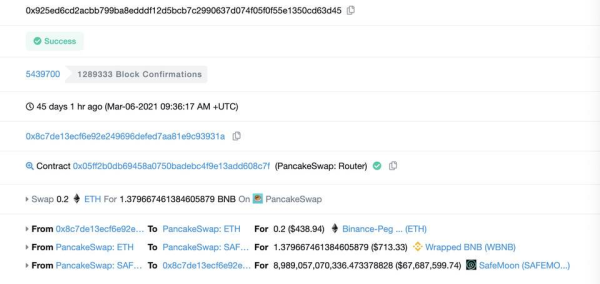

According to a trading log circulating on the internet, an investor turned 0.2ETH into $ 6,700 in just a few days by investing in Safemoon.

Behind the high rewards is Safemoon’s excellent design of the trading rules. To ease the pressure to sell, Safemoon has innovatively introduced high transaction fees and automatic burning. The high transaction fee mechanism is designed to reward long-term owners, with a 10% transaction fee charged for each transaction. The fee is used to reward owners of existing tokens. An automatic burning mechanism would withdraw digital coins from circulation and a reduction in supply would increase the price of the token.

Such a mechanism fits perfectly with the current popular HOLD culture. As long as they all hold up, it will inevitably lead to a long-term uptrend in currency rates and generally beneficial results. Although the reason is simple, Safemoon has strengthened its mechanism through trading rules and brought unexpected success.

It can be seen that Safemoon uses an innovative mechanism design to prevent price fluctuations due to large and frequent transactions, supports price stability and is friendlier to retail investors who hold tokens for a long time. To ensure growth in value while achieving stable and long-term curve returns.

But Safemoon’s recent depreciation also shows us Safemoon’s shortcomings. What Safemoon lacks is a longer term development perspective and a larger market

Consensus. In the course of time, any Defi project, if there is only a jump in value and a lack of internal support, will quickly enter the phase of fading.

Statue of Liberty, a new star from Defi who has received a lot of attention, has solved that problem. As an innovative DeFi application, the Statue of Liberty continued the design of Safemoon’s excellent trading rules at the beginning of its development to make them friendlier to long-term retail investors. In addition, as mentioned above, the Statue of Liberty has also drawn up a long-term development plan and through a number of market activities it has attracted a great deal of attention worldwide, building consensus beyond the crypto market.

statue of Liberty:Defi integrated with Dao will be the future development trend

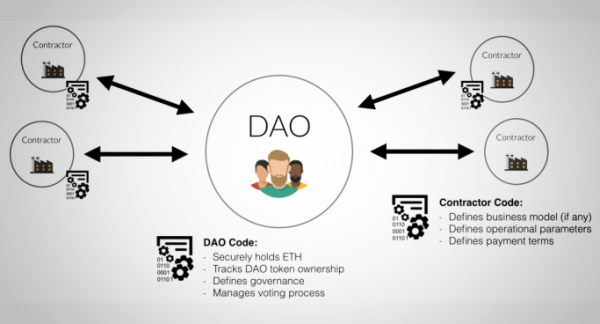

In an interview, Smith said: “The GOVERNANCE model of THE DAO is based on the collective control of power by the members of the organization, which is conducive to the initiative of the members of the organization and the long-term development of the project by building and sharing together.”

There have been cases when DAO was used in defi. Smith pointed out that the integration of Dao into Defi will be the future development trend. In the current Defi project, the lack of enthusiasm among DAO voters for participating in the Defi project is the main problem of the Defi project. For example, the Statue of Liberty wanted to improve the DAO organization’s user experience by innovatively introducing forecasting or betting to motivate members, vote and contribute to the community.

The ultimate goal of encouraging users to participate in the community is to enable community members to understand the trading rules and project mechanisms so that they are ready to make recommendations and promotion on the fly and reach greater consensus. Smith said, “In order for the project to have long-term development, people need to understand the substance of the deal. If they only understand the transaction and don’t actively discuss it, people will not be part of any party transaction. “

The development of DeFi applications has become the development trend of the encryption market. As a rising star, the Statue of Liberty has implemented several innovations in terms of technology and mechanisms, and has created broad market consensus through a range of market behaviors. By employing innovative DAO, the Statue of Liberty is eagerly awaited by the market.

DeFi is a useful addition to the current finance industry, and DAO will be a powerful addition to Defi. We believe that as DeFi matures and blockchain technology iterates, DeFi projects like the Statue of Liberty mixed with DAO will be the financial system that plays an increasingly important role or even dominates the future of the code world.